Is being a landlord more stress than it’s worth? Approximately 42.3% of rental properties are managed directly by their owners. That means a substantial number of landlords oversee day-to-day operations themselves.

A tired landlord has owned rental property for longer than a decade. The average age of a homeowner selling property in America is approaching 61. That means most landlords are approaching the retirement age as they are looking to sell.

You can buy rental properties from landlords who don’t want them anymore. These properties have appreciated over the years, and the homeowners have gained substantial equity. That’s why these owners are ready to prioritize convenience and certainty over the highest sales price. It gives you an opportunity to acquire those assets below the market value.

Another benefit is an established rental history. You can access data regarding realistic income potential and the management-related expenses. The right strategy can help increase your ROI even if these properties have been under-optimized by previous owners.

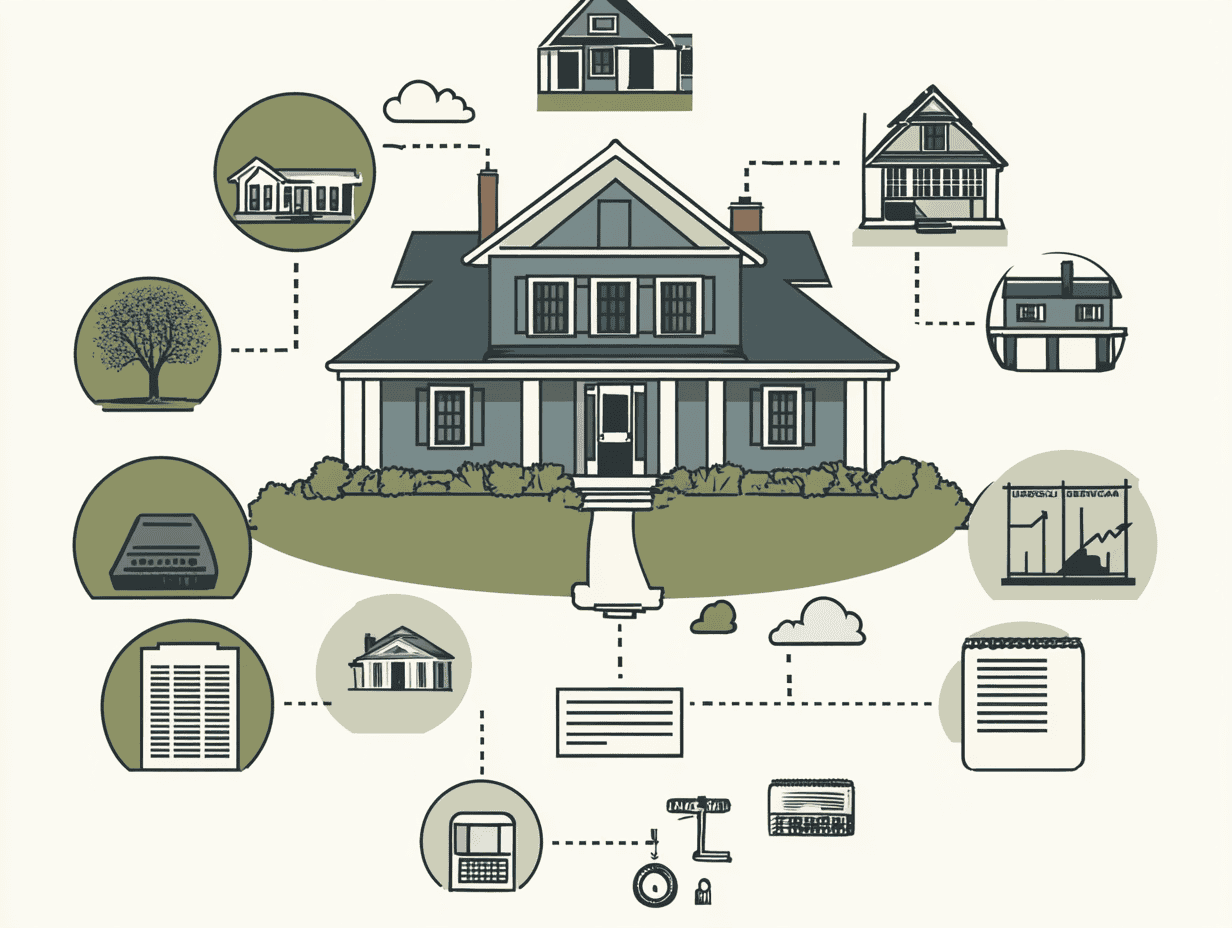

PropStream—one of the most comprehensive investor tools that aggregates public record data. It allows you to filter for:

BatchLeads - Focuses on providing property and owner data with strong skip-tracing capabilities to find contact information. Includes filters for:

ListSource - Allows you to build mailing lists based on property and owner characteristics:

County Assessor Websites - Many counties now offer advanced search features on their public-facing property appraiser sites (free but typically limited to one county)

REISkip - Specializes in finding contact information for property owners once you've identified potential leads

Retiring landlords want convenience and speed. It’s best to communicate how you solve their specific problem. Your services can include buying a property with tenants, purchasing in as-is condition, or buying a distressed property. Focus on the relief and solutions rather than a simple cash offer.

Your offer can highlight benefits such as:

You can create dedicated website landing pages that can capture traffic from PPC campaigns. Through targeted social media advertising, you can reach landlords based on age, interest, and geographic location. With this approach, you can filter the uninterested people and reach landlords who might be willing to sell.

You can also focus on SEO around keywords like:

Your ad conversion rate will be small. Out of 100 people, only a few will respond to your marketing efforts. Consider retargeting to reach prospects who have shown interest but didn’t reach out. Develop ads to address common objections or questions that arise while prospective landlords are considering your service.

Direct outreach remains one of the most effective methods for reaching distressed sellers. However, direct mail or cold-calling might not be the best approach for contacting seasoned investors. Experienced landlords have a network and prefer working with trustworthy investors who know the industry. You can reach out to landlords and have a friendly conversation. Your qualifying questions might include:

Property managers and management companies interact regularly with frustrated landlords. These companies know firsthand when a landlord is facing difficulty with their rental business. If you can establish relationships with these companies, you can market yourself as a cash buyer who helps landlords. You can create referral criteria along with a potential reward for each lead that is referred to you.

You should contact real estate attorneys and CPAs who advise landlords regarding their investment portfolio. As an investor, your services can be a valuable solution for complex situations involving significant repairs or high vacancy. A qualified financial consultant can refer your services to landlords.

Contractors and maintenance professionals frequently see landlords at their most frustrated moments. Build relationships with service providers who can recommend your services when they encounter owners expressing fatigue or frustration with ongoing maintenance requirements. Other real estate investors can also recommend leads that don’t fit their acquisition criteria. You can arrange a reciprocal effort for exchanging leads with other investors.

Landlords are interested in topics about exit strategy plans, tax implications, and retirement income alternatives. Through your network or local organization, you can host informational events on these topics. Make sure your content is genuinely helpful for landlords looking to transition. After the workshop, ask simple polling questions about management frustrations to identify potential motivated sellers. The same questions can be used to develop material for future events.

Real estate investors should qualify properties using standardized assessment methods. Your checklist can include:

Most landlords face common concerns. As an investor, you should be prepared to handle those concerns and explain your answer. For example:

Hard money and private money are not your only options. You can consider seller financing for landlords who want additional income without managing rental properties. These arrangements can offer tax benefits to sellers through installments while they reduce your acquisition costs.

There can also be lease options to allow for transitional arrangements. Such a deal structure is favorable for landlords who want to exit active management but are hesitant about selling their long-held asset. You can also negotiate a partnership with landlords who are not yet ready for a complete exit. You can take over management responsibilities while gradually acquiring ownership interest in a multifamily property.

You can also acquire these motivated seller leads by signing up for our service. At Motivatedsellers, you receive motivated seller leads looking to work with you. Our service allows you to work directly with distressed sellers without having to find them.