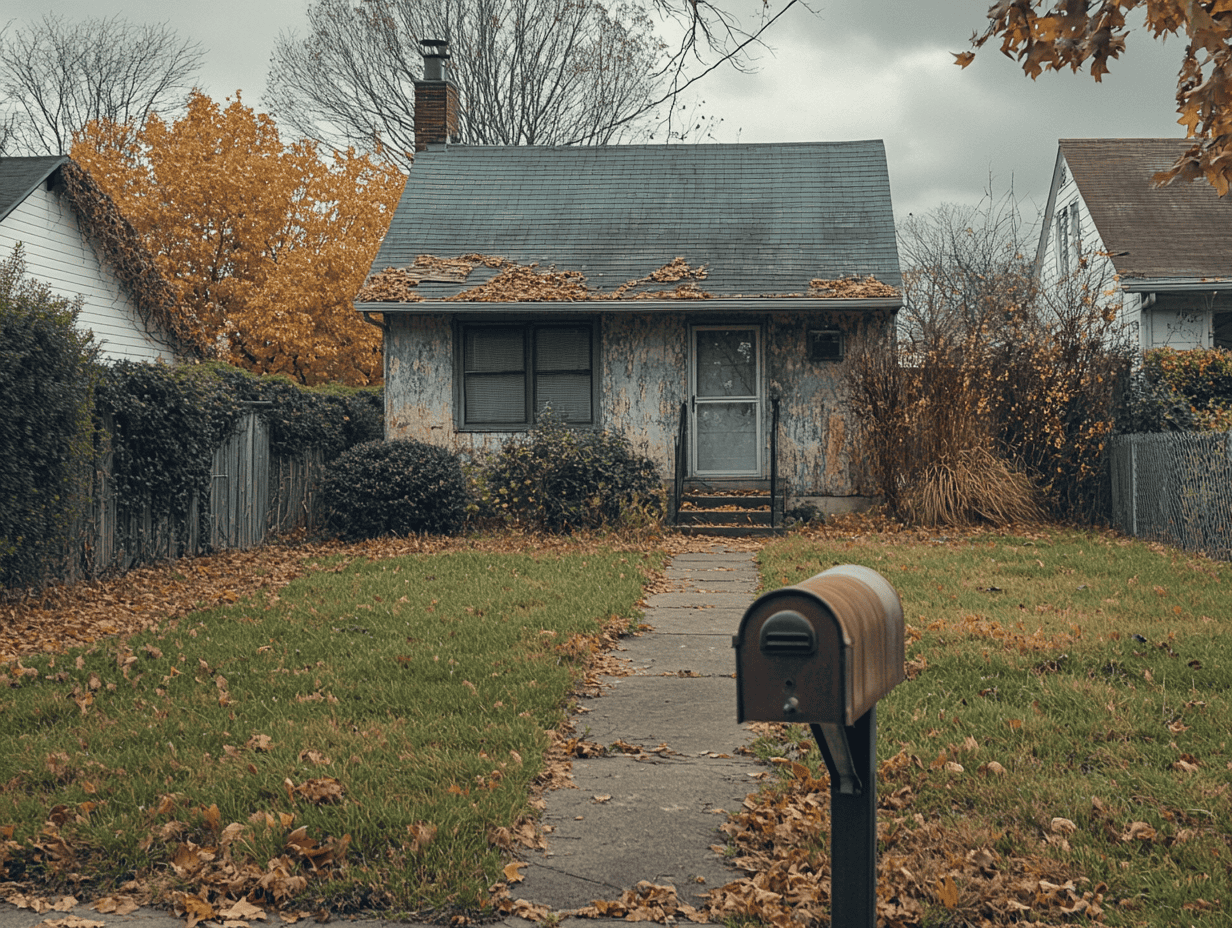

Real estate investors should approach elderly sellers looking to sell their properties. You can target downsizers and seniors who need your help.

According to the U.S. Census Bureau, by 2030, all baby boomers will be over 65, meaning one in every five Americans will reach retirement age. These senior homeowners aged 62 and above collectively hold $14 trillion in home equity as of early 2024.

For investors willing to learn the nuances of this segment, the potential rewards go beyond monetary profit. It’s a chance to make a meaningful impact on families during a challenging transition.

Senior homeowners are less likely to trust your brand on Facebook. Your communication strategies should differ from those used for younger sellers. Homeowners 65 and older prioritize face-to-face communication, prefer printed materials over digital, and value relationship-building over transaction. You should address them with respect, compassion, and care. These homeowners have worked hard their entire lives to build their homes. If you observe their thought patterns, you’ll see them worrying about:

Most senior homeowners involve family members while making financial decisions. That’s why it’s important to earn the trust of the entire family—not just one member. You can build trust by being transparent, honest, and a reliable source of information for motivated sellers.

Baby boomers strongly favor direct mail. Direct mail marketing has an average response rate of 4.9% versus 1% for email campaigns. Your direct mail should be designed to cater to the needs of this audience. Use large-size fonts (minimum 14 pt). Keep your language clear and avoid overly technical industry jargon. Senior homeowners prefer value-driven messaging. It’s important to state the facts, be transparent, and offer specific solutions to common problems. You can include testimonials from other senior homeowners who have had a great experience selling to you. The envelope design should be clean and professional, with multiple contact options, including phone, email, and text.

You can package your content marketing efforts into mailers and send them to your targeted audience. Helpful pieces can include educational resources addressing specific concerns like the best guide to downsize your home in Chicago, and selling options for senior homeowners with limited mobility.

Baby boomers are more likely to trust you if your services are referred to them by someone they trust. Build your referral network with professionals who work with these demographics. Connect with elder law attorneys, estate planners, retirement planning financial advisors, and senior care managers. Over time, your network can help provide valuable, motivated seller leads.

Educational seminars and local events provide one of the best opportunities to connect with senior homeowners. You can host seminars on topics like downsizing or understanding your home’s value in today’s market. These potential topics can draw attention when you properly market them through senior centers, places of worship, and community bulletins. You can also host community participation events like:

Elder law attorneys and estate planners are dealing with a specialized audience. They will not refer clients in exchange for a referral fee. Attorneys will only refer clients to real estate professionals who demonstrate specialized knowledge and ethical practices.

Many real estate agents choose specialized certifications to work with senior clients. As an investor, you can tap into these certifications to understand the unique challenges associated with this market segment. Available certifications include:

These certifications can further help you build a resource network of senior services. You might connect with senior move managers, estate liquidation companies, elder law attorneys, senior financial advisors, and assisted-living placement specialists.

Ethical business practices are critical when working with distressed homeowners.

Ethical practice is paramount when working with vulnerable populations. A study by the Consumer Financial Protection Bureau found that seniors lose an estimated $3 billion annually to financial scams, many related to housing. Real estate investors working with seniors must be vigilant about providing fair market value offers regardless of the situation. You can provide a transparent offer calculation process. You must

Opportunities in the real estate sector arise from changing demographics, developing wealth patterns, and new housing needs. You can find various investment opportunities if you’re willing to tap into this potential market. Experienced investors working with seniors can deliver value for homeowners while expanding their real estate business.

Success in these specialized markets requires more than traditional real estate knowledge. It demands empathy, specialized communication skills, and patience.