Tax planning is a critical task for real estate investors. Without efficient tax planning, you could be giving away 20% to 30% of your returns to the IRS unnecessarily. It’s important to understand how you can reduce your tax burden to reinvest more cash into your business.

In this article, we’ll discuss strategies, tools, laws, and tips to help you save money on taxes while growing your portfolio.

Real estate investment income is subject to specific tax rules governed by the Internal Revenue Service (IRS). The income generated from various investment vehicles is taxed differently, and the tax treatment depends on how the income is derived (e.g., rental activities, selling real estate, or depreciation recapture).

Rental income for landlords is considered ordinary income and will be taxed in the same way. The capital gains tax applies if the gain exceeds $250k ($500k for married couples). Capital gains can be short-term or long-term, depending on the holding period. If you have depreciated the property previously, there can be a depreciation recapture tax when selling the property.

Real estate investors primarily deal with three categories of taxable income:

Let’s say you buy a property for $200,000 and renovate it for $50,000. You then calculate depreciation deductions worth $30,000. The adjusted basis of your property will account for value-added renovations and depreciation. In this case, the adjusted basis for tax purposes will be $220,000.

Depreciation allows investors to deduct a portion of a property’s cost over its useful life. For residential rental properties, the IRS uses a 27.5-year depreciation schedule, while commercial properties are depreciated over 39 years. This tax benefit reduces taxable rental income but requires careful tracking and reporting.

Passive Activity Loss Rules and Real Estate Professional Status

The Passive Activity Loss (PAL) rules limit how real estate investors can offset losses from rental properties against other income. However, an investor can qualify for Real Estate Professional Status by meeting specific criteria, such as spending more than 750 hours annually in real estate activities. Achieving this status allows them to deduct losses against other forms of income.

You can defer capital gains tax when selling an investment property if you reinvest the sale proceeds into a similar property of equal or greater value. A 1031 exchange allows investors to avoid capital gains tax while continuing to grow their portfolio. Funds are held in a reserve until they are reinvested into another property within 180 days.

“Rather than selling properties outright when upgrading to larger commercial investments, we've consistently used 1031 exchanges to defer capital gains taxes. This allowed us to preserve approximately $215,000 in capital when moving from residential to commercial properties last year, effectively keeping that money working for us rather than paying it to the IRS.” — CEO at Greenlight Offer

“For our fix-and-flips, we use 1031 exchanges religiously. We recently sold a warehouse we held for 18 months with a $430K gain and immediately rolled the proceeds into two smaller retail properties, deferring all capital gains taxes. This preserved about $95K in working capital that would have gone to taxes.” — Brett Sherman (Signature Realty)

The Qualified Business Income Deduction (QBI) allows real estate investors to deduct up to 20% of qualified business income earned from rental properties, provided certain conditions are met. This deduction is available to pass-through entities like LLCs, S-corporations, and partnerships. However, its application can be complex, depending on income levels and the type of property.

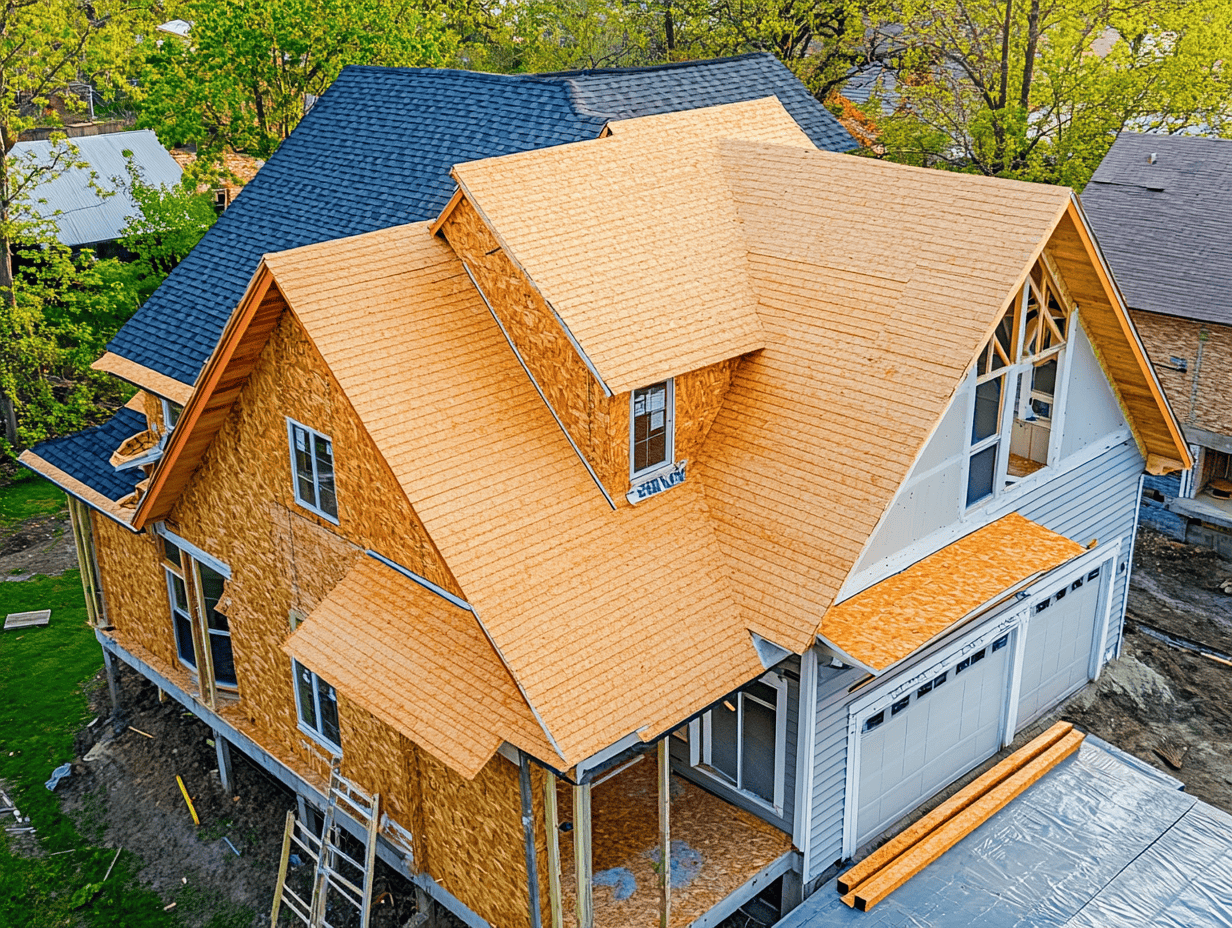

Capital improvements are substantial upgrades that add value, such as a new roof or a fully renovated kitchen. These costs contribute to the property’s basis and are depreciated over time. Repairs, on the other hand, are routine fixes that maintain the property’s condition and can be fully deducted in the year they are incurred.

Real estate investors have a wide array of tax deductions and credits to help reduce their overall tax liability. Common deductions include mortgage interest, property taxes, insurance premiums, and maintenance costs. You can deduct these everyday operating expenses to minimize your tax burden.

Real estate investors are entitled to numerous tax deductions and credits that help reduce their overall tax liability. Understanding and maximizing these benefits is critical for improving profitability.

Are you driving around to visit rental properties or meeting with contractors? You can deduct a portion of your travel expenses, including fuel, maintenance, and insurance. Some travel expenses for business-related trips, such as airfare, can also be deducted. Keep detailed records of these expenses to ensure they meet IRS requirements.

You can claim the home office deduction if a portion of your house is exclusively and regularly used for property management or investment-related activities. You can deduct a percentage of household expenses (utilities, rent, internet, etc.) based on the portion of your home used for business purposes.

Going green can help reduce your tax burden. If you invest in energy-efficient property renovations—such as installing solar panels, energy-efficient windows, or geothermal heating systems—you may be eligible for federal tax credits. These incentives can significantly reduce the upfront cost of green upgrades while lowering long-term operational expenses. For example, the Investment Tax Credit (ITC) for solar installations allows you to deduct a percentage of the installation cost from your taxes.

Cost segregation remains one of the most powerful tools for real estate investors who want to minimize taxes. According to the CEO of Greenlight Offer, cost segregation helps reduce your tax bill when you need cash flow.

“On a $350,000 residential property we converted to light industrial last year, this approach front-loaded approximately $75,000 in deductions within the first year, compared to the standard 27.5-year depreciation schedule.”

Instead of depreciating an entire office building over 39 years, you can hire engineers to identify components (wiring, flooring, fixtures) that qualify for 5-7 year depreciation.

A cost segregation study allows real estate investors to accelerate depreciation on certain property components. You can classify parts of a property, such as flooring, appliances, and landscaping, as short-lived assets. These can be depreciated over 5, 7, or 15 years, instead of the standard 27.5 or 39-year timeline. Doing so can lower your taxable income in the early years of ownership. Accelerated depreciation can lead to large tax savings, especially for properties with substantial improvements or renovations.

Sam Zoldok highlights the tremendous tax advantages available through Opportunity Zone (OZ) investments.

“In 2019, I rolled capital gains from a medical office disposition into an OZ fund targeting Birmingham's revitalization areas, completely deferring taxes on the original gain until 2026 while setting up future appreciation to be tax-free after the 10-year hold.”

By investing in designated Opportunity Zones, you can receive preferential tax treatment. Capital gains tax can be deferred and potentially excluded if you hold the property for a 10-year period.

A smart entity structure can positively impact your tax liability. Real estate investors often choose to form an LLC or an S-corporation to minimize liability while maximizing tax advantages. Tax matters can be complicated, so it’s best to consult a professional tax advisor.

LLCs offer flexibility in taxation, allowing profits to be either taxed at the entity level or passed through to owners, avoiding double taxation. An S-Corp election allows investors to avoid self-employment taxes on rental income, provided the property is actively managed. The right entity structure depends on the investor’s goals, income levels, and liability considerations.

IRAs serve as a powerful tax-saving tool for holding and growing investments. A Roth 401(k) allows tax-free growth and withdrawals if certain conditions are met. Self-directed IRAs can be transformative for your business model. You can let rental income and appreciation grow tax-deferred while creating immediate tax savings. Some investors choose to use IRA funds for private or hard money lending purposes. Although the complexities require solid legal guidance, the ability to build wealth through real estate inside a tax-advantaged account is worth navigating the rules.

Cash buyers must close quickly on deals, but timing the sale can help you save on taxes. If you close deals in December rather than January, you can secure an entire year’s worth of depreciation deductions, even if you only own the property for a few weeks in that tax year.

These strategies have been employed by both new and seasoned investors to save thousands of dollars. You can continue contributing to your local communities while minimizing your tax burden. Join motivatedsellers.com to receive exclusive, local distressed leads and continue growing your business.