How much time does your team spend chasing leads every day?

Think about it.

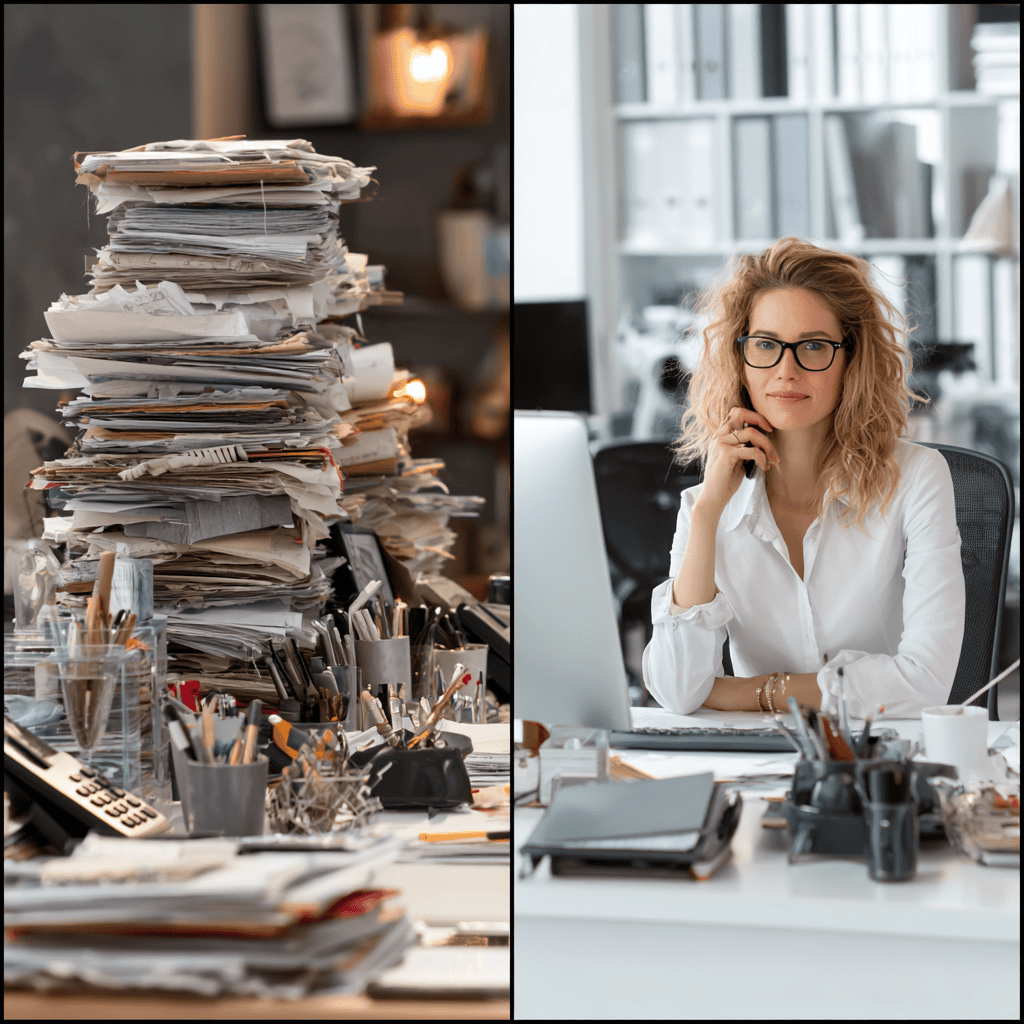

Your team could be spending months chasing a few hundred motivated seller leads. Hundreds of phone calls, dozens of property visits, and countless follow-up emails. In the end, you close a few deals. Meanwhile, another investor focuses on just 10 quality leads, closes one or two deals, and still has 300 hours to spare for the next opportunity.

The difference? Lead quality. And it is costing you more than you think.

Here is the reality. You can make more money, but your time is limited. Every hour your team spends chasing unqualified sellers is an hour they are not closing actual deals. Most investors will agree that it takes 20 to 50 leads to close a single deal. Experienced investors need fewer leads to close, while newbies have a lower conversion rate.

What is your conversion rate from the leads you are getting? Do you have a follow-up strategy?

NAR estimates the conversion rate to be 0.4% to 1.2% for real estate agents. Real estate investors have a higher closing rate of 1.52%, with one deal closed per 66 leads.

Many homeowners seeking a sale are not motivated at all. As an investor, you must look for predictable characteristics in your lead type.

Quality leads come through inbound channels, which are primarily PPC advertising and content marketing. These sellers are actively searching for your company. Inbound marketing costs 61% less than outbound marketing.

Here are a few stats about content marketing and PPC ads.

Premium leads interact with your brand before reaching out. They have read your content, seen your reviews, and understand your local reputation. This psychological shift changes everything when you’re trying to close a deal.

When your business is discovered through targeted search advertising or organic content marketing, the resulting leads arrive with higher intent. These homeowners are not gathering opinions from every investor in town. They are searching for solutions.

Volume is useful early. However, volume without filtering becomes a liability as soon as you want predictable lead generation.

Following up on a lead takes three to four hours per lead when you factor in the initial call, multiple follow-up attempts, property research, and CRM documentation. For 100 low-quality leads, that’s 350 hours of cold calling and administrative work.

At $40–50 per hour, you’re looking at $14,000–17,500 in labor costs alone. Compare that to 10 quality leads requiring five hours each of dedicated follow-up—just 50 hours total, costing $2,000–2,500.

That’s a difference of 300 hours that could be used to close three to five additional deals instead of chasing dead ends.

Low-quality leads generate appointments, but many are no-shows or turn out to be completely unrealistic. From 100 leads, you might drive to 40–50 properties, averaging 30 miles round trip.

The real expense is time. Each property visit consumes roughly four hours when you include drive time, the walkthrough, and post-visit documentation. At $75–150 per hour for an investor or acquisitions manager’s time, each visit costs $300–600.

Do the math: 45 property visits multiplied by $300–600 per visit equals $13,500–27,000 in total driving-related expenses for those 100 low-quality leads.

By contrast, 10 quality leads generate one to two serious appointments with sellers who are motivated and ready to talk numbers.

Beyond the obvious expenses, low-quality leads drain resources in subtle ways. Your CRM fills with dead-end contacts requiring constant cleanup and data management. Your team burns out from endless rejection and unproductive conversations, leading to turnover that costs thousands in recruitment and training.

Marketing dollars get wasted trying to “warm up” sellers who were never serious in the first place. Every dollar spent on follow-up campaigns to unresponsive leads is a dollar not invested in attracting quality opportunities.

Have a conversation, and within five minutes, you can uncover the true motivation behind a call. It might not be true motivation if you hear answers like, “Just curious what it’s worth” or “Seeing what’s out there.”

Watch for sellers who can’t answer basic questions about the property or ownership status. And if they mention, “I’ve talked to several investors already,” you’re likely dealing with a lead that’s been sold to a dozen other buyers. Read our book about negotiating with motivated sellers to uncover hidden needs.

In your initial qualifying call, ask these questions immediately:

Depending on your business strategy, you’ll need to make some tactical changes.

Stop doing:

Start doing:

The investors who dominate their markets aren’t the ones with the most leads. They’ve built teams that attract and convert the best leads. They’ve built systems that attract quality opportunities and quickly disqualify low-quality ones, allowing them to focus their energy where it actually produces results.