Today it’s a conversation about private money.

It doesn’t matter whether you have ever raised private money or not. Your experience doesn’t matter here. You’ll discover the exact script to have people give you funds for investing in real estate. Pay attention and you’ll find hidden gems throughout this conversation.

You can watch the full interview on our YouTube channel.

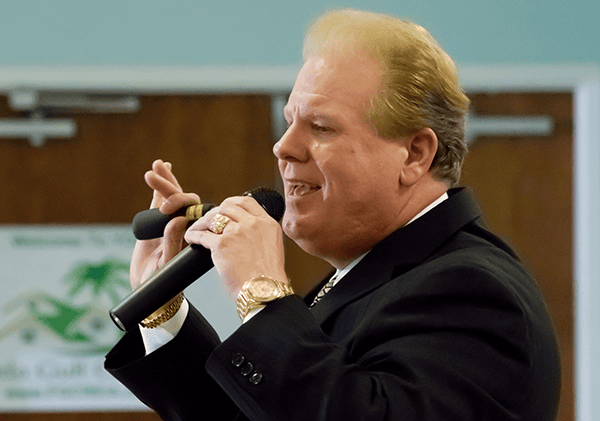

Jay Conner started investing in real estate back in 2003. He lived in Eastern North Carolina (Morehead City) with his wife, Carol Joy.

“There are about 40,000 people in the market. In this small market, we have bought, sold, and rehabbed over 500 houses. From 2003 to 2009, my main funding source was the local bank. I had an unsecured line of credit (worth $250,000) with my local bank. The bank would fund the deal whenever I found an investment property. It was good until the financial crisis happened and the bank suddenly decided to cut my line of credit.”

I found a foreclosed (bank-owned) property in ‘Homes Magazine.’ I purchased the house for $50k, spent $50k on the rehab and listed the house on MLS for $139,900.

Surprisingly, the house kept sitting on the market without any showings for 45 days. It was a beautiful house but nobody came to see it.

I was reading a book on ‘creative selling’ and read something interesting.

“Put an ad in the paper, offer owner financing, and your house will sell fast.”

I did the same. Then a buyer called me, asking for property location so he could see it.

I said it’s a bit difficult to find the house in Morehead city, but if he can meet me at the Seco gas station, I will take him to the house.

I had 2 houses under contract. I called the bank to request funding for investment purposes. To my surprise, the bank had cut off my line of credit without notice. I had to close on those two properties but I had no funding available.

There is a powerful question that you can apply to any problem in life:

“Who do you know that can help fix this problem?”

I had a friend, Jeff Blankenship, who was also investing in real estate. I called him and told him about the incident. He said, “Welcome to the club.” The banks were not lending money to investors because of the global financial crisis.

I asked, what are we supposed to do next?

That’s was the first time I heard about private money.

The worst time to raise private money is when you need it. Build awareness and raise money before you have a deal.

Raising private money is always a two-step process. You educate prospective lenders about private money and then you have a separate conversation about the deal to fund. These two conversations cannot happen simultaneously

I started talking to people in my warm network, like the people you see every everyday. I taught them about private money. I put together a small educational program that highlighted points such as:

I asked my students to move money into a self-directed IRA once they liked my program and were ready to invest funds. I only talked about the deal once all the educational steps were complete and funds were ready.

Here is the exact script to help you secure private money for your investment deals.

“I have got great news. I can put your money to work for you. I have a got a house over in Newport with an ARV of $200,000. The funding required is $150,000. The closing is due next Tuesday. You need to wire funds from your retirement account to my real estate attorney’s trust account. I am going to have my real estate attorney email you the wiring instruction”.

That’s it.

There is no chasing involved in the whole conversation. I teach people about private money. I promise them to make their money work for them. Now I am ethically bound to invest their money. People are actually thankful because they are earning a higher interest rate. They can plan a better financial future because you are helping them invest money.

Private money comes from an individual who has retirement savings or investment capital. We protect the private lender. A mortgage or deed of trust is used to collateralize the promissory note. We name the private lender on the insurance policy as the mortgagee and also on the title insurance.

Hard money is often provided by brokers and comes with steep interest rates. In today’s lending environment, a hard money loan could cost between 12% and 14%, while private money comes in closer to 8%. Hard money also includes extra fees, such as origination and extension charges.

Hard money lenders generally finance 60–80% of the purchase price. Private money can fund 100%, including renovation expenses.

This isn’t meant to diminish the value of hard money lenders. That said, building a network of private lenders can give you quicker and more affordable access to liquid cash.

Jay Conner raised 2 million dollars in his first 90 days of discovering private money. Most of that money came from his immediate connections in a church Bible study. He helped people who were worried about low returns in the stock market and local banks.

I choose to sell immediately for all deals financed through private money. For creatively financed deals (subject-to or seller financing), I prefer to sell on terms.

Money is everywhere. Ordinary people with a retirement account will lend you money if you show them the way. You will find private money lenders everywhere if you look in the right direction.

That’s not true. We, as borrowers, are our own underwriters. Real estate investors set the terms and conditions of the loan.

Most investors have a fear of rejection as they try to raise private money. Here is a thing to keep in mind:

You are not asking about money. You are not asking for anything.

Always lead with an attitude of service. Real estate investing is not all about you making money. It’s about offering an opportunity to other people who never heard of private money. You are making their life better by offering increased financial returns.

I will learn under a mentor who knows what to do. I lost hundreds of thousands of dollars because I didn’t know what I didn’t know. Always find a coach before you have a problem, and you’ll get light-years ahead of the game.

I want to get in better shape. I have reached a place where I want to help people transform their businesses. I want to teach investors how to take control of their investing business by using private money.

Connect with Jay now and receive his latest book with two tickets valued at $3,000 to The Private Money Conference - https://www.jayconner.com/